Please share this page with these links to Facebook, Twitter, LinkedIn and Email:

“Number one, cash is king…

number two, communicate…

number three, buy or bury the competition.”

– the late Jack Welch, God rest his soul

Number One, Cash is King

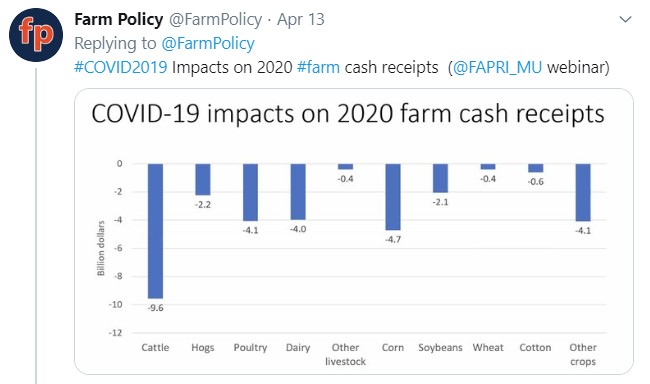

How are your cash receipts going to be impacted by COVID-19?

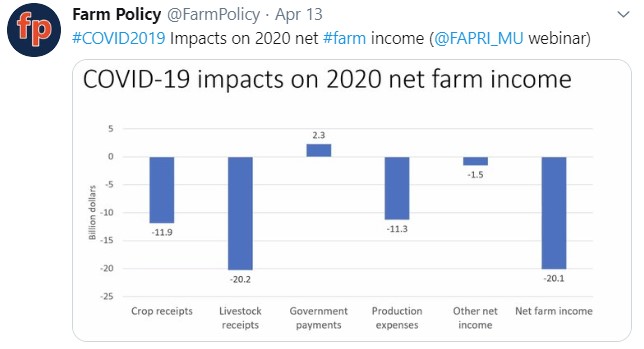

FAPRI projects a $32.2 billion decrease in farm cash receipts in 2020 due to COVID-19. As you work with your consultants and advisors to determine your future, what do your projections show for 2020 and 2021 based on what you know under various scenarios?

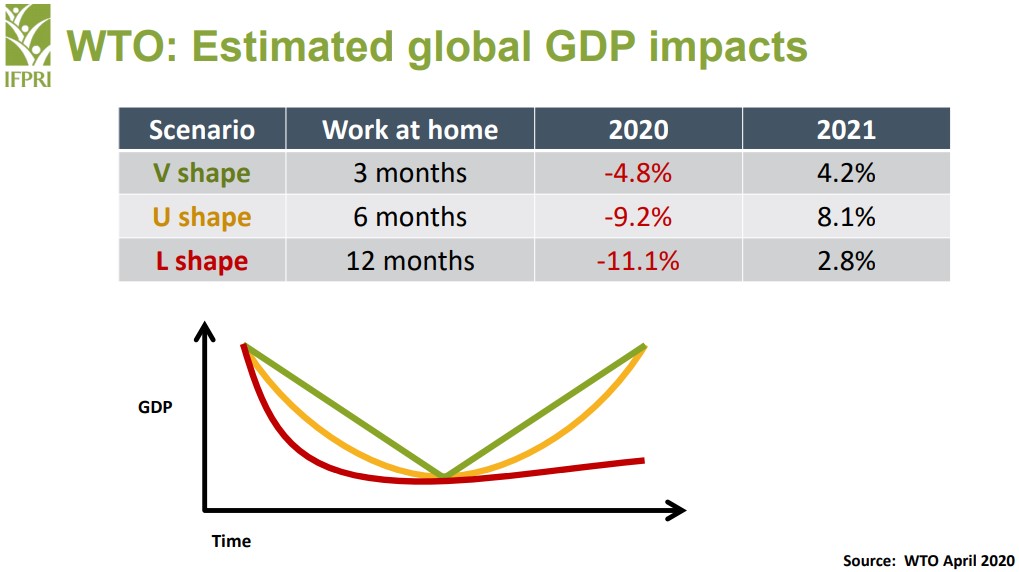

In a recent farmdoc presentation, University of Illinois Agricultural Economist Nick Paulson and International Food Policy Research Institutes’s Joe Glauber showed three scenarios that the WTO is using to project estimated global GDP impacts. Are you looking at similar scenarios?

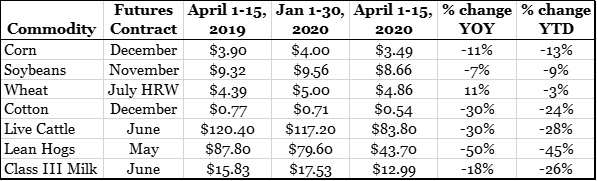

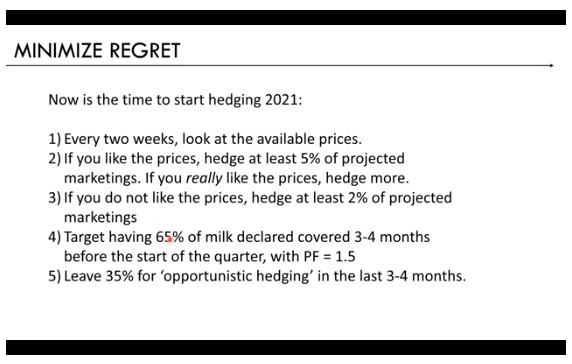

Have a business plan including a marketing plan and work with it even when you are busy doing other things. Your consultant can help with this to minimize the time it takes. There will be opportunities to lock in prices in 2021 and 2022 that you won’t regret just like there have been for 2020.

Gregg McConnell and Marin Bozic delivered a great webinar by Farm Credit East, ACA about the time that should be spent on a risk management strategy for 2021 to “minimize regrets”. While the webinar is dairy focused, the concepts apply to all sectors.

The cards are pretty well dealt for 2020 and they will need to be played appropriately to get to 2021. That doesn’t mean that risks can’t be managed differently in 2021. This plan presented above is one of many strategies that are available.

Work with your consultant to set a strategy that works for you including the time involved, the frequency of review and most importantly, one that reflects the changing environment you are operating in.

What are you doing to make sure you get your fair share of the cash?

The U.S. Department of Agriculture is throwing a tremendous amount of cash at agriculture to make up for some of the lost revenues. The latest reports show a new $16 billion in direct government payments going to agriculture with $9.6 billion for the livestock industry ($5.1 billion for cattle, $2.9 billion for dairy, $1.6 billion for hogs), $3.9 billion for row crop producers (with most expected to go to corn and the rest going to soybeans, cotton and others), $2.1 billion for specialty crop producers and $500 million for other crops.

How much each farmer receives will be largely based on how the USDA wants to support large vs. small producers by using individual dollar caps vs. basing it solely on production. The government is even opening up some of their Small Business Administration loan programs to agriculture which is a first but again is focused on small businesses, not large agriculture corporations with over 500 employees. If you don’t feel like you’re getting your share, notice that the poultry industry is projected to have a revenue decrease larger than dairy, yet is not getting any allocation in the $16 billion.

Are your costs generating cash?

In this environment, cash expenditures must be critically examined to prioritize needs before wants. Some commodity input costs such as energy, protein, purchased livestock, fuel and fertilizer are naturally coming down while others such as labor, DDGs and imported supplies might be increasing due to availability.

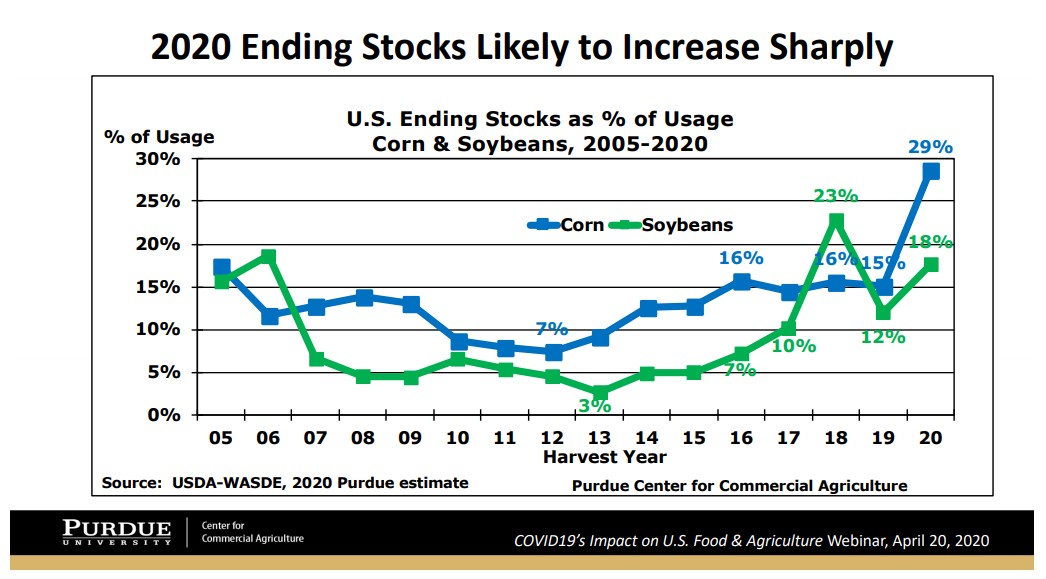

The Purdue Center for Commercial Agriculture has predicted in a recent webinar that before the 2021 U.S. corn crop is harvested, there could be enough corn from the 2020 crop left over to meet almost 30% of the annual corn demand. That would be a record high level going all the way back to the over supply and resulting low prices of the 1980’s.

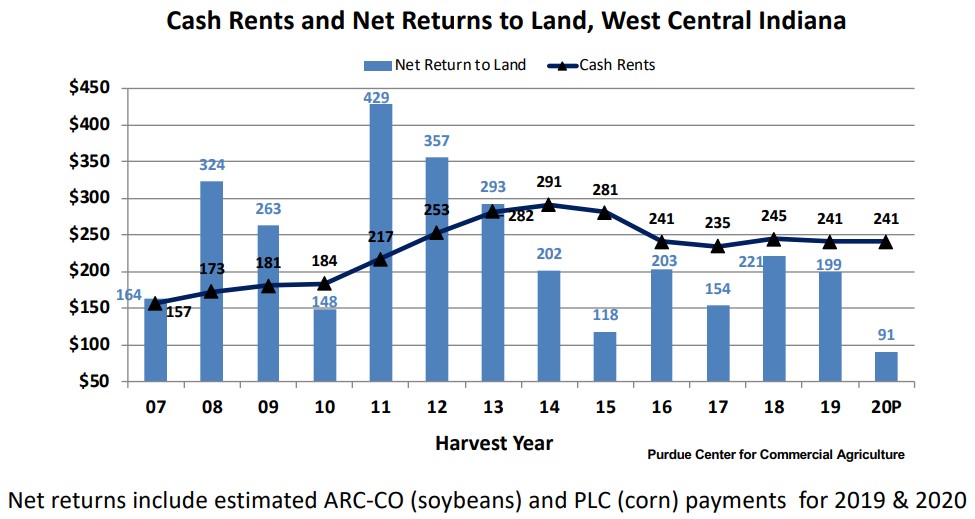

While low corn and bean prices are good if you are buying feed, it is not good if you are buying or renting high priced land to produce a crop that doesn’t cash flow. Cash rents far exceed returns to the land and must come down to reflect the profitability of farming those acres.

Now would be a good time to have a projection that can be tweaked with updated scenarios that will look quite different from those that were run two months ago. Projections must be developed and an emphasis on both business spending and personal financial habits will be critical.

Be thinking about fall fertilizer, fuel and feed costs now and have a plan as you go throughout the year. Have a rolling 12 month plan where you at least look at opportunities before you produce the product. Focus on field by field and animal by animal decisions to manage cash.

What are your top spending and investment priorities given various scenarios? What could impact the availability of key resources, supplies, processors and markets? Closely monitoring projections and activities will be crucial as you manage your business.

Number Two, Communicate

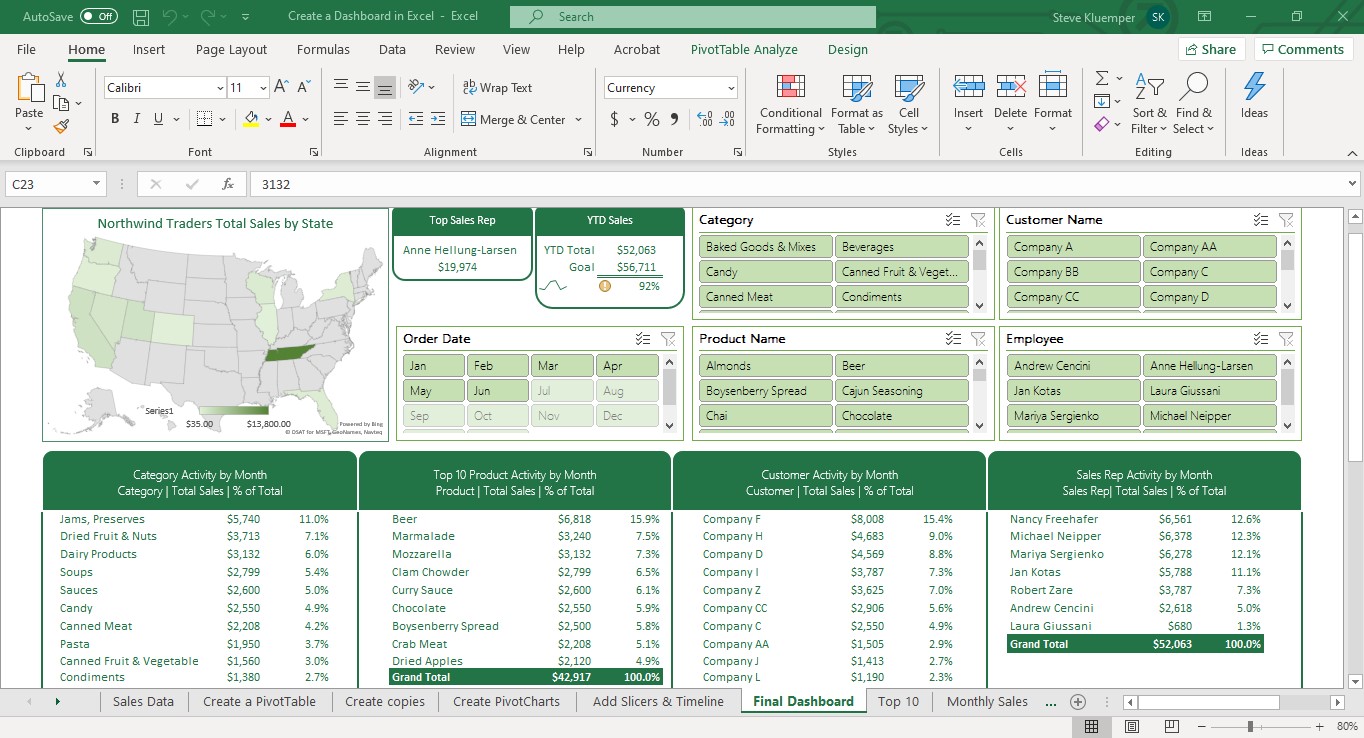

Communicating with Dashboards

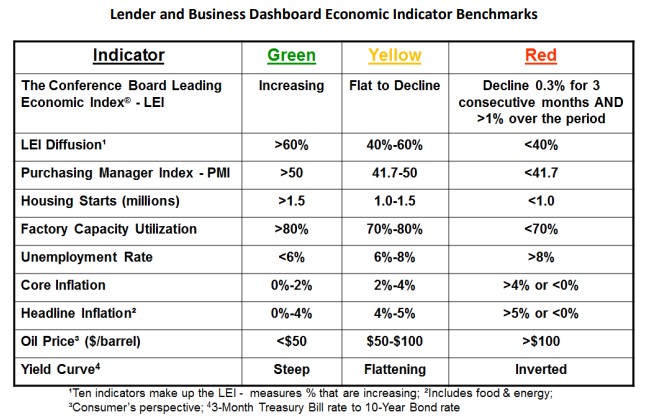

In Dr. David Kohl’s article for Farmer Mac he talks about the importance of communicating with stakeholders. Dashboards are a great way to do that. His dashboard benchmarks for farmers and lenders is shown above.

As you work with your consultant to build your dashboard that you use to run your business and change it with various metrics over time, decide which metrics are appropriate to share with your spouse, family, employees, customers, vendors, lenders, investors, etc.

Give these various stakeholders a dashboard that is appropriate for them. Ask them to have one that they share with you as well. Make sure to include metrics about how you’re doing personally and emotionally and seek input from your stakeholders on how they’re doing and see you doing as well.

Communication is even more important in these volatile times. While things change rapidly, having a process to keep your most important stakeholders informed and able to provide their input is crucial. Don’t go through this alone. Let others pull on the rope with you and appreciate the successes and failures together.

Communicating with Capital Providers

Timely, accurate and concise communication with capital providers such as lenders, vendors and investors is very important, especially when you want them to relax rates and terms, defer payments, restructure obligations or even provide more capital now or in the future.

In this environment, Dr. Kohl talks about the need to have a written marketing and business plan that lays out the details of your future plans and monitors economic shifts to justify these requests and show how the stakeholders shouldn’t be harmed.

The plans will need to be clear and concise and supported well enough so that the person you present it to can use it to present it to their superiors and regulators who usually make the final decision without meeting with you.

Try to find ways to establish a relationship with the credit analysts and credit committees to build your support within their organization. Be ready to take the time or use your consultant to answer follow-up questions and provide additional details.

“As headwinds facing the agricultural economy persist, insured institutions must be prepared for agricultural borrowers to face financial challenges by employing appropriate governance, risk management, underwriting, and credit administration practices.” “Managing risk over the life of a loan includes: carefully documenting all lien perfections and other loan instruments; closely overseeing sale proceeds; conducting timely, independent collateral inspections; and developing a process for monitoring collateral values.” “A continuous credit grading program can help management identify credit risk early and take preemptive steps to prevent further deterioration.”

Keep in mind this guidance coming from the FDIC that will be seeing tremendous stress across most industry portfolios at their banks and especially in agriculture which has been struggling for a few years while the rest of the economy was improving. Everyone has someone to answer to and they need you to help them gather the answers.

Number three, buy or bury the competition

Assessing your Competitive Strengths and Cash Resources

Buy, Bury, Be Bought or Be Buried. Which of these four paths will you take? What are your strengths? What resources do you have available to you? You need competitive strengths and cash resources to execute your plan. With only cash resources and no competitive strengths, you can potentially buy strengths to be competitive. With only competitive strengths with no cash resources, you will need to raise cash to be competitive, usually by selling all or part of the business. With neither cash resources, nor competitive strengths, you will be buried.

Answering these questions and determining how to manage your business in this new environment can be accomplished during the process of developing your business model and a strategic plan that will generate cash and manage risk. AgriStrategies LLC can help you with this.

Excess Cash is Better than Insufficient Cash

Take matters in to your own hands. Ask for liquidity from lenders, vendors and investors when it’s available so that you have the cash to run and grow your business. Don’t wait until it’s needed. Make your case that you are thinking ahead and have a business plan as compared to others that are just going to wait and see what happens until they are bought or buried.

Maximizing liquidity and cash from all sources is crucial for the success of your business. Even if your business doesn’t need it, one of your key vendors or customers or even competitors might need a lifeline that could benefit your business. It’s important to put yourself in a situation to take advantage of these opportunities.

Cash is King. Communication is Crucial. Crush the Competition.

AgriStrategies LLC can help!